Do your Business Supply Contracts contain a Retention of Title clause?

What is a Retention of Title Clause?

A Retention of Title Clause (‘ROT’) is a provision in a Contract for sale of goods which states that the supplier retains legal ownership of the goods until certain obligations are fulfilled by the buyer – usually payment of the purchase price.

ROT clauses can take 2 forms:

- A specific goods clause – this clause states that legal ownership of the goods does not pass to the buyer until the buyer has paid for those goods.

- All monies clause – this clause states that legal ownership of all goods supplied by the supplier to the buyer does not pass to the buyer until the buyer has paid all outstanding invoices to the supplier.

Many ROT clauses also state that any monies received by the buyer from a sale of goods which are subject to a ROT Clause are held in trust for the supplier and not mingled with the buyer’s general funds. Traditionally the ROT Clause was used by the supplier to reclaim the goods if they had not been for paid for, or to claim goods from a liquidator if the buyer became insolvent.

How is a Retention of Title Clause set up?

The ROT Clause must be incorporated into the contract between the buyer and the supplier. This is preferably done at the start of the trading relationship by incorporating the ROT Clause in the Supplier’s Credit Account Application and Terms of Trade. It can also be done on a transaction by transaction basis by incorporating it in the supplier’s tax invoice to the buyer.

How have ROT’s been changed by the Personal Property Security Act (‘PPSA’)?

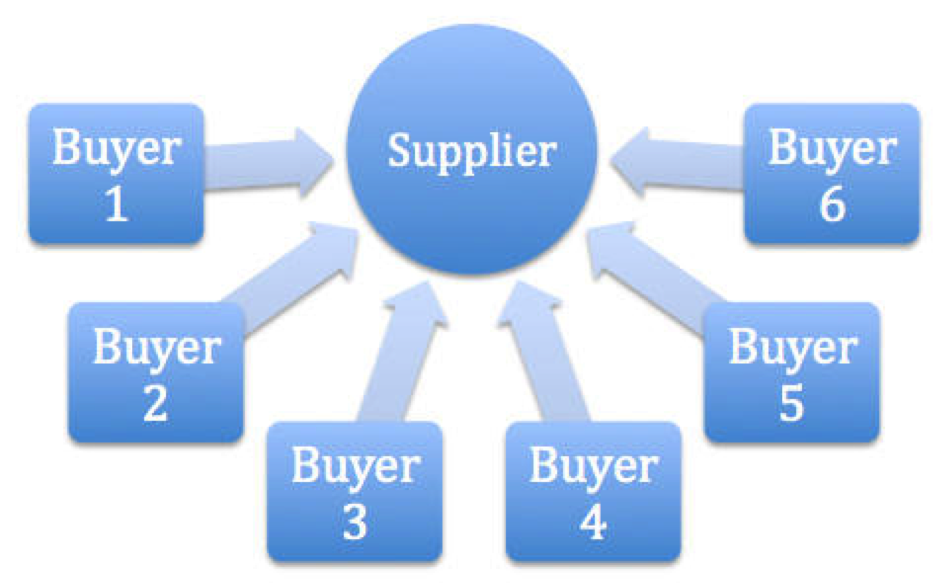

The PPSA has changed the way we think about ROT’s. The PPSA now disregards the supplier’s title and treats the arrangement as if it were the same as a secured loan. This means that under the PPSA the buyer will be regarded as the owner of the goods who has granted security over them back to the supplier. The supplier’s right is now known under the PPSA or a ‘security interest’, and it is a particular type called a ‘PMSI’, being a purchase money security interest. This security interest is only a PMSI to the extent that it secures unpaid amounts. Once the goods have been paid for it, is no longer a PMSI. This limits an ‘All monies’ ROT Clause only to security over goods that have not been paid for.

The PPSA introduces prescribed enforcement rules if the goods have not been paid for so that, unless these rules are excluded, the supplier can no longer enforce the ROT Clause by reclaiming the goods from a late or non-paying buyer.

The PPSA also introduces an extinguishment rule which allows a customer of the buyer of goods who purchases those goods in the ordinary course of business from the buyer, to take title of those goods free of the security interest of the supplier in the goods.

How does the Supplier get protection under the PPSA?

The PPSA sets up the Personal Property Security Register (PPSR) which is a statutory system of registration of security interests in personal property being goods that have not been supplied mainly for domestic personal or household use. It also establishes priorities between competing security interests. The PPSA generally confers priority to an earlier registered security interest over a later registered security interest, and to registered security interests over unregistered security interests. If the security interest is a PMSI and it is registered, it has a super priority. An ROT is a PMSI.

Registration is therefore the key. A failure to register the security interest on the PPSR does not invalidate the rights of the supplier, but it does have 2 important ramifications:

- The rights of the supplier to enforce its security will be subordinated to a higher ranking (registered earlier in time) security interest covering the personal property of the buyer.

- If the buyer is wound up, or has voluntary administrators appointed, the supplier’s unregistered security interest vests in the buyer. The supplier loses its security interest in the goods the subject of the ROT, and must claim its debt as an unsecured creditor in the insolvent administration.

What should the supplier do to protect is ROT rights under the PPSA?

As stated earlier, registration of the PPSR is the key. Once the ROT clause is on the PPSR, it is given a super priority over other normal security interests. Other incentives to register are that a registered ROT Clause allows the supplier to retain security over goods even if they are co-mingled with or attached to other goods, and if the extinguishment rule applies, the supplier may still have an interest in the sale proceeds of the goods.

There is a sting in the tail with ROT registrations and it concerns the timing of the registration. If the goods supplied comprise inventory (ie goods held by the buyer for resale, for consumption, or are raw materials or work in progress), the supply contract needs to be registered before the next delivery of the goods. If delivery of inventory is made before the PPSR registration, it will not attract the PMSI super priority, and the supplier risks losing priority to an earlier registered security interest, such as to security held by the buyer’s bank. If the goods are not inventory, registration must be within 15 days of delivery of the goods.

To achieve protection by registration, the supplier must first ensure that a written agreement exists between the supplier and the buyer that incorporates the ROT Clause. This is best done by ensuring the buyer signs a Credit Account Application and Terms of Trade incorporate the ROT clause and will apply to all supplies made to the buyer. The ROT clause should also be included in the supplier’s tax invoices.

By having the buyer sign the Credit Account Application and Terms of Trade, the supplier can make a single registration on the PPSR. If no Credit Account Application and Terms of Trade exist, but the ROT Clause exists in the supplier’s tax invoice, to receive PPSA protection for its ROT Clause, the supplier will need to make a separate PPSR registration for each tax invoice. This is cumbersome.

Lessons

Suppliers should:

- Ensure ROT clauses are incorporated within their contracts, invoices, credit account applications and terms of trade, and tax invoices;

- Review their existing contracts, credit account applications and terms of trade and tax invoices to ensure the PPSA prescribed enforcement rules are excluded, to ensure they limit the extinguishment rules, and to preclude terms in the buyer’s purchase order overriding the ROT Clause.

- Ensure the supplier holds written evidence of the signed contract, credit account applications etc

- Ensure registration of the PPSR as a PMSI accurately describing the goods, prior to delivery of the goods.

Conclusion

If you would like assistance to review your credit account application and terms of trade, or would like more information or need assistance with any business matter, please call our accredited business law specialist, Michael Battersby on 02 4731 5899 or email commercial@batemanbattersby.com.au.

Download PDF Version:

Do your Business Supply Contracts contain a Retention of Title clause?